Introduction

Insolvency is a complex and often daunting process, one that impacts multiple parties connected to the financial health of an organization. From creditors to employees and shareholders, all stakeholders in insolvency have legal rights that are essential to the resolution of the financial distress. Understanding these rights not only helps in ensuring that stakeholders can protect their interests but also helps them to engage constructively with the insolvency process. This article explores the various rights stakeholders hold during insolvency proceedings, outlining the responsibilities of insolvency practitioners and the legal protections in place to balance competing interests.

What is Insolvency?

Insolvency refers to the situation where an individual or a company is unable to pay off their debts when they fall due. Insolvency can take various forms, ranging from complete liquidation to corporate restructuring aimed at rescuing the company. Understanding the rights of stakeholders in insolvency begins with distinguishing between two major forms of insolvency:

Cash-flow insolvency

: This occurs when a business is unable to pay its debts as they become due, despite having sufficient assets.

Balance-sheet insolvency: In this scenario, the company’s liabilities exceed its assets, meaning it owes more than it owns.

For both types of insolvency, legal frameworks exist to determine how assets should be managed, creditors should be paid, and employees should be treated. This legal framework, which governs the rights of all involved stakeholders, varies from country to country but typically revolves around common principles of fairness, transparency, and accountability.

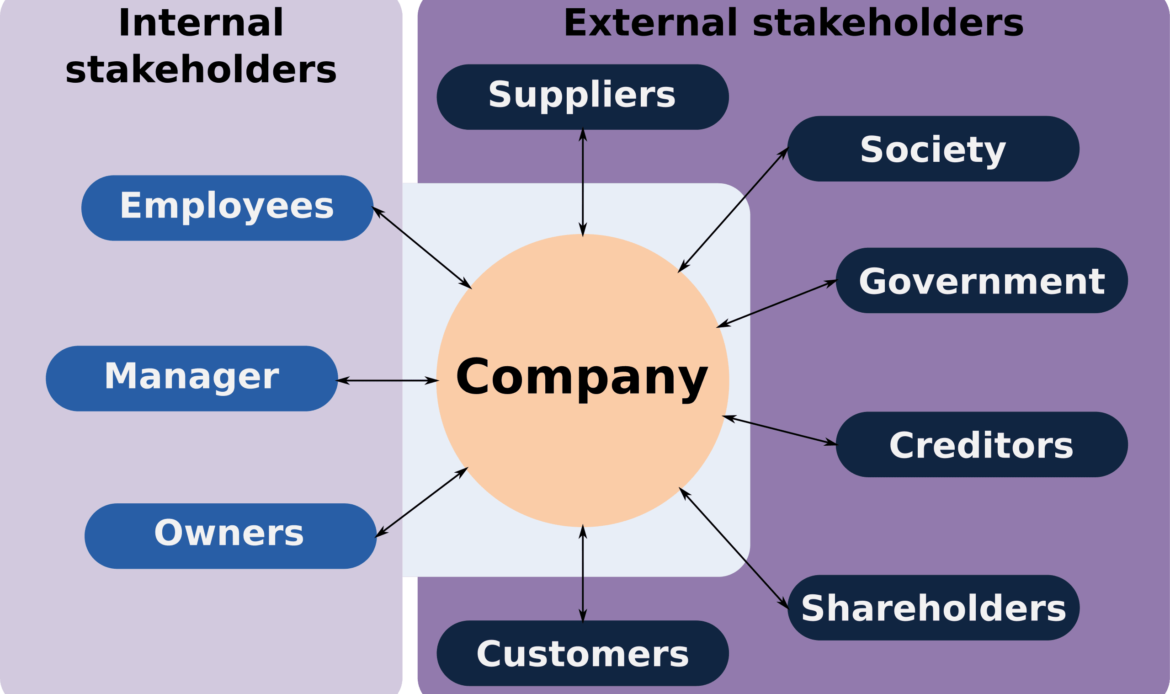

Key Stakeholders in Insolvency

In any insolvency process, the following stakeholders are critical:

Creditors

: These include secured creditors, unsecured creditors, and preferential creditors, all of whom have rights related to repayment of the debt owed to them.

Employees

: As individuals whose livelihoods are impacted by the insolvency process, employees have rights to wages, benefits, and severance pay.

Shareholders: Shareholders hold ownership in the company and have certain residual rights after all creditors are paid.

Directors and Officers

: The company’s management team must navigate their fiduciary duties while ensuring compliance with the legal obligations that arise during insolvency.

Insolvency Practitioners

: These professionals, often appointed by courts or creditors, manage the insolvency process and ensure that all stakeholders’ rights are respected.

Understanding the Rights of Creditors in Insolvency

Creditors are among the most crucial stakeholders in any insolvency process, as they are owed money by the insolvent company. Their rights vary depending on whether they are secured, unsecured, or preferential creditors.

Secured Creditors: These creditors have lent money against a specific asset or collateral, such as property or equipment. In the event of insolvency, secured creditors have the right to seize and sell the secured assets to recover their money. They are given priority in receiving payment over other creditors because their loans are backed by valuable assets.

Unsecured Creditors

: These creditors do not have a claim to any specific assets and are considered to be at higher risk during insolvency. Their rights include the ability to file claims for unpaid debts and vote on any restructuring or liquidation plans. However, they are paid only after secured and preferential creditors are satisfied, often receiving reduced or no repayment.

Preferential Creditors

: Preferential creditors hold special status due to the nature of their claims, such as unpaid wages or certain taxes owed to the government. Their claims are paid before unsecured creditors but after secured creditors. For example, in many jurisdictions, employees owed wages or pension contributions are classified as preferential creditors.

Rights of Employees in Insolvency

Employees are another critical group whose rights must be protected during insolvency. Insolvency law often includes provisions that ensure employees are treated fairly, even when their employer is unable to continue operating. Key employee rights during insolvency include:

Wage Claims

: Employees are entitled to unpaid wages up to a certain amount, and in many jurisdictions, these claims are given preferential status, ensuring they are paid ahead of other unsecured creditors.

Severance Pay

: If the company is liquidated, employees have the right to severance pay, depending on the length of their employment and applicable labor laws. In some countries, government schemes may cover these payments if the company cannot meet its obligations.

Redundancy Compensation

: In cases where the company is restructured, resulting in layoffs, employees have the right to redundancy compensation. Employers are typically required to provide notice of impending layoffs and consult with employees before dismissing them.

Transfer of Employment Rights

: When a business is sold during insolvency proceedings, employees may have the right to transfer their employment contracts to the new owner. This process ensures continuity of employment and preserves employee rights.

Shareholders’ Rights in Insolvency

While shareholders hold ownership rights in a company, their rights in insolvency are generally subordinate to those of creditors. Shareholders’ main rights during insolvency include:

Residual Claims

: Once all creditors have been paid, shareholders may have the right to any remaining assets. However, in most cases of insolvency, especially liquidation, there are no surplus assets left after the creditors have been paid.

Voting on Restructuring Proposals

: In some insolvency processes, particularly company voluntary arrangements (CVA) or restructuring, shareholders may be given the opportunity to vote on the proposed plans. This allows them to have a say in the company’s future direction, though their influence is usually limited compared to that of creditors.

Information Rights

: Shareholders have the right to be kept informed about the insolvency proceedings. This includes receiving periodic reports from insolvency practitioners on the progress of the liquidation or restructuring.

Rights of Insolvency Practitioners

Insolvency practitioners are appointed to oversee and manage the insolvency process, ensuring that all stakeholders are treated fairly and in accordance with the law. Their primary responsibilities include:

Managing the Company’s Assets

: Insolvency practitioners take control of the company’s assets and are responsible for selling them off or reorganizing the company to repay creditors.

Paying Creditors

: Insolvency practitioners distribute the proceeds from asset sales or restructuring to creditors in accordance with the legal hierarchy of claims. They must ensure that secured, unsecured, and preferential creditors are paid in the correct order.

Providing Information

: Insolvency practitioners are required to provide regular updates to stakeholders about the status of the insolvency process, including financial reports and details about how the company’s assets are being handled.

Conclusion

Understanding the rights of stakeholders in insolvency is essential for navigating the often complex and sensitive insolvency process. Creditors, employees, shareholders, and insolvency practitioners all have specific roles and responsibilities that are critical to resolving financial distress in a fair and transparent manner. By recognizing these rights, stakeholders can protect their interests and engage effectively in the insolvency process, ensuring that they receive the treatment and compensation they are entitled to under the law.

Contact Us

For premier legal research services in Insolvency law cases in Nigeria, contact Chaman Law Firm today. Our offices are conveniently located in Lagos, FCT Abuja, Ogun State, and the UK. We are readily available to assist you with your legal needs. Whether you require consultation, representation, or ongoing legal support, Chaman Law Firm is your trusted partner in navigating Insolvency law in Nigeria.

Call us at 08065553671 or email us at info@chamanlawfirm.com to schedule a consultation.

- Bankruptcy Law

- Liquidation Procedures

- Corporate Restructuring

- Creditor Rights

- Personal Insolvency

Chaman Law Firm: Your Trusted Legal Partner in Insolvency Law

By choosing Chaman Law Firm, you are selecting a team of dedicated professionals committed to providing exceptional legal services tailored to your unique needs. Let us be your advocate and guide in the complex world of Insolvency law, ensuring your interests are protected and your goals are achieved.