The Harsh Truth: Understanding the Difference Between Personal and Commercial Debt Recovery

Introduction

In the complex world of finance, debt recovery plays a crucial role in maintaining economic stability and ensuring that businesses and individuals can manage their obligations effectively. At Chaman Law Firm, we understand the intricacies of debt recovery and offer tailored solutions to meet the diverse needs of our clients. One of the key distinctions in the field of debt recovery is between personal and commercial debt. While both involve the collection of unpaid debts, the methods, legal considerations, and strategies can vary significantly. This article explores the differences between personal and commercial debt recovery and the unique challenges and opportunities they present.

Debt recovery is an essential practice in the world of finance and law, providing creditors with a legal pathway to reclaim money owed to them. This process can be vital for ensuring that those who are owed funds can recover their debts and maintain financial stability. Whether the debt involves a personal loan, a business transaction, or a commercial agreement, understanding the differences between personal and commercial debt recovery is crucial. Each type of debt recovery has its own distinct processes, challenges, and legal implications that creditors must navigate.

When we talk about personal debt recovery, we are referring to the process of collecting debts owed by individuals to other individuals or entities. This might include unpaid loans, medical bills, rent arrears, or credit card debts. The debtor is usually a person, and the amounts owed can range from small sums to significant amounts, depending on the nature of the debt.

However, personal debt recovery can be a complicated and emotional process, especially when the debtor is a friend, family member, or colleague. The dynamics of relationships can make it harder for creditors to recover the money owed, leading to strained personal ties or complicated negotiations.

The process of recovering personal debts often starts with informal efforts, such as phone calls, emails, or letters, requesting repayment. If these initial attempts fail, creditors may escalate the issue by hiring debt collection agencies, which specialize in tracking down and recovering unpaid debts.

In some cases, if the debtor remains uncooperative, legal actions such as lawsuits may be required. However, the personal nature of the debt often means that the creditor may be hesitant to pursue legal action, particularly if the debtor is someone they know. This can lead to delays or the possibility of a less-than-satisfactory resolution.

On the other hand, commercial debt recovery involves the process of recovering money owed by businesses to other businesses or individuals. This kind of debt arises from unpaid invoices, outstanding loans, or breaches of contract within the business setting. The size of the debts in commercial debt recovery is often much larger than in personal debt cases, and the legal and financial procedures involved are more complex. Commercial debt recovery can involve a wide array of transactions, from unpaid supplier bills to unresolved business loans, making the landscape of recovery much broader.

Unlike personal debt recovery, which often relies on informal measures such as phone calls or emails, commercial debt recovery typically follows a more formalized path. Businesses tend to have established protocols for debt collection, such as issuing formal demand letters, engaging legal teams, and seeking arbitration or court intervention. The legal tools available for commercial debt recovery are more robust and comprehensive. In many cases, businesses can pursue legal judgments against debtors, and if necessary, initiate bankruptcy proceedings if the debtor’s financial position is unstable. This formal approach helps ensure that creditors can recover their money, even if the debtor refuses to pay voluntarily.

What makes commercial debt recovery more challenging than personal debt recovery is the sheer scale of the debts involved. Businesses are usually dealing with larger sums of money, which means there is more at stake. The potential financial impact of unpaid debts can be significant, affecting a company’s cash flow, credit ratings, and long-term sustainability. Consequently, businesses tend to be more aggressive in their recovery efforts, and the legal framework governing commercial debt recovery is much more structured and clearly defined.

Furthermore, the recovery of commercial debts is not just about reclaiming the money owed; it’s also about protecting a business’s reputation. Unresolved debts can harm a business’s credibility and strain relationships with clients, suppliers, and partners. This is why commercial debt recovery is treated with greater urgency, and businesses may resort to legal actions like court proceedings, arbitration, or even seizing assets to recover outstanding debts.

Understanding these differences between personal and commercial debt recovery is critical. The approach to recovering a debt depends heavily on whether it involves an individual or a business entity. While personal debt recovery may start with informal negotiations and the involvement of debt collection agencies, commercial debt recovery is often a more structured and legally rigorous process, with higher stakes and more formalized legal tools at play. It is essential for creditors, whether individuals or businesses, to understand the most effective ways to handle debt recovery in each scenario.

Understanding Debt Recovery

Debt recovery refers to the process of pursuing the payment of debts owed by individuals or businesses. It involves various strategies, including negotiation, mediation, litigation, and enforcement of judgments, to recover the outstanding amounts. The process aims to ensure that creditors are compensated for the goods or services they have provided, while also considering the debtor’s circumstances and ability to repay.

Personal Debt Recovery

Personal debt recovery involves collecting debts owed by individuals, such as credit card debt, personal loans, medical bills, and utility bills. It often requires a more personalized approach, as individual debtors may face unique financial challenges and circumstances.

1. Legal Framework

Personal debt recovery is governed by consumer protection laws that vary by jurisdiction. These laws are designed to protect individuals from unfair or abusive debt collection practices. In many countries, debt collectors must adhere to strict regulations, including providing clear information about the debt, respecting privacy rights, and refraining from harassment or intimidation.

2. Communication and Negotiation

Communication with individual debtors requires sensitivity and empathy. Many personal debtors may be experiencing financial hardship, and understanding their situation can lead to more successful negotiations. Offering flexible repayment plans, interest rate reductions, or settlements can be effective in reaching an agreement that satisfies both parties.

3. Psychological Factors

Personal debt recovery involves dealing with emotions and stress. Debt collectors must be skilled in handling emotional conversations and finding solutions that address the debtor’s concerns. Building trust and rapport with debtors can increase the likelihood of successful recovery.

4. Legal Actions and Limitations

In personal debt recovery, legal actions such as filing a lawsuit or obtaining a judgment may be necessary if negotiations fail. However, pursuing legal action can be time-consuming and costly, and it is often viewed as a last resort. Additionally, there may be legal limitations on the types of assets that can be seized or garnished to satisfy a personal debt.

Commercial Debt Recovery

Commercial debt recovery involves collecting debts owed by businesses, including unpaid invoices, trade debts, and loans. The process can be more complex due to the involvement of corporate entities and legal considerations specific to commercial transactions.

1. Legal Framework

Commercial debt recovery is governed by commercial law, which may include specific regulations related to business transactions, contracts, and insolvency. Unlike personal debt, commercial debt recovery often involves negotiating with other businesses, requiring a strong understanding of commercial practices and regulations.

2. Business-to-Business Relationships

In commercial debt recovery, maintaining business relationships is crucial. Collectors must balance the need to recover outstanding debts with the desire to preserve valuable business partnerships. This requires a diplomatic approach, as well as the ability to negotiate terms that benefit both parties.

3. Financial Analysis

Commercial debt recovery involves analyzing the debtor’s financial situation, including their cash flow, assets, and liabilities. This information can be used to assess the likelihood of recovery and develop a strategy that maximizes the chances of success. Understanding the debtor’s industry and market conditions can also provide valuable insights.

4. Legal Actions and Enforcement

In commercial debt recovery, legal actions may be more common due to the complexity of business transactions and the potential for disputes. Legal options may include filing a lawsuit, obtaining a judgment, or pursuing insolvency proceedings. However, litigation can be expensive and time-consuming, so alternative dispute resolution methods, such as mediation or arbitration, are often preferred.

5. International Considerations

Commercial debt recovery can become more complicated when dealing with international debts. Differences in legal systems, currency exchange rates, and cultural practices can create additional challenges. Understanding the legal and economic environment in the debtor’s country is essential for successful recovery.

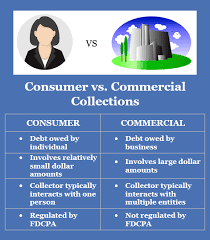

Key Differences Between Personal and Commercial Debt Recovery

1. Legal Considerations

Personal debt recovery is governed by consumer protection laws that prioritize individual rights and privacy, while commercial debt recovery is subject to commercial law and focuses on business transactions and contracts.

2. Approach and Strategy

Personal debt recovery requires a personalized approach that considers the debtor’s financial situation and emotional state. In contrast, commercial debt recovery involves negotiating with businesses and requires a strategic understanding of commercial practices and financial analysis.

3. Relationship Management

Maintaining positive relationships is crucial in commercial debt recovery to preserve business partnerships. Personal debt recovery involves building trust and empathy with individual debtors.

4. Financial Complexity

Commercial debt recovery often involves analyzing complex financial information and market conditions, while personal debt recovery focuses on the individual’s financial situation and ability to repay.

5. Legal Actions

Legal actions are more common in commercial debt recovery due to the complexity of business transactions, while personal debt recovery may involve legal actions as a last resort.

Challenges and Opportunities in Debt Recovery

Debt recovery presents both challenges and opportunities for creditors and debt collectors. Understanding the differences between personal and commercial debt recovery allows for more effective strategies and tailored solutions.

1. Compliance and Regulation

Compliance with legal regulations is essential in both personal and commercial debt recovery. Navigating the legal landscape and staying informed about changes in laws and regulations is crucial to avoid legal issues and reputational damage.

2. Ethical Considerations

Ethical considerations play a significant role in debt recovery. Treating debtors with respect, transparency, and fairness is essential to maintaining a positive reputation and fostering trust.

3. Technological Advancements

Technological advancements have transformed the debt recovery process, offering new tools and platforms for communication, negotiation, and data analysis. Leveraging technology can enhance efficiency and improve the chances of successful recovery.

4. Alternative Dispute Resolution

Alternative dispute resolution methods, such as mediation and arbitration, offer opportunities for amicable settlements and can reduce the time and cost associated with litigation. These methods are particularly valuable in commercial debt recovery, where preserving business relationships is a priority.

5. Globalization and Cross-Border Recovery

Globalization has increased the complexity of debt recovery, particularly in commercial transactions. Understanding the legal and economic environment in different countries is essential for successful cross-border recovery.

Conclusion

Debt recovery is a vital aspect of the financial ecosystem, ensuring that creditors receive the compensation they are owed while considering the debtor’s circumstances. The differences between personal and commercial debt recovery highlight the need for tailored approaches and strategies that address the unique challenges and opportunities in each area. At Chaman Law Firm, we are committed to providing expert guidance and innovative solutions to navigate the complexities of debt recovery. Whether dealing with personal or commercial debt, our team of experienced professionals is dedicated to achieving successful outcomes for our clients.

Now that we have explored the primary differences between personal and commercial debt recovery, it’s clear that although both processes aim to recover outstanding debts, they are governed by different sets of rules, practices, and challenges. The approach to recovering personal debts is typically more informal and less structured, while commercial debt recovery involves a more formalized and complex legal framework.

One of the most significant differences between personal and commercial debt recovery lies in the legal tools and processes that are available. Personal debt recovery often starts with informal communication, such as phone calls or letters. If these efforts fail, creditors may turn to third-party debt collection agencies or pursue legal action through the courts.

This type of debt recovery is governed by consumer protection laws, which are designed to ensure that debtors are treated fairly and that the recovery process does not become oppressive or abusive. Personal debt recovery, therefore, tends to be less aggressive and more focused on maintaining personal relationships while still trying to recover the debt owed.

In contrast, commercial debt recovery typically involves a more formal approach from the outset. Businesses often have legal teams or departments dedicated to handling debt collection, and they follow a set process that begins with issuing formal invoices or demand letters. If payment is not made within a reasonable timeframe, businesses may escalate the matter to legal action.

In the case of a commercial dispute, businesses can pursue arbitration, court cases, or even bankruptcy proceedings to recover their funds. The legal framework around commercial debt recovery is comprehensive and designed to handle the larger sums of money and more complex transactions involved in business dealings. This formal approach helps ensure that businesses have a clear path to recover debts and protect their financial interests.

Another key difference lies in the impact that debt recovery has on personal relationships versus business relationships. When a creditor is pursuing personal debt recovery, there is often an emotional aspect involved. The debtor may be a friend, family member, or colleague, and the creditor may be reluctant to take aggressive action due to the potential for damaging personal relationships. This emotional complexity can sometimes lead to delays in debt recovery, as the creditor may be hesitant to pursue legal measures or escalate the issue.

On the other hand, commercial debt recovery is typically more transactional and less emotionally charged. While businesses may have long-term relationships with clients or suppliers, the focus of debt recovery is usually on the financial aspect. There are fewer personal stakes involved, making it easier for businesses to take swift and decisive action to recover the money owed. This makes the commercial debt recovery process more streamlined and efficient, even though the stakes may be higher.

In terms of the debt amounts and the complexity of the debt, commercial debt recovery typically involves larger sums of money than personal debt recovery. This often leads to more complicated legal proceedings, as businesses have more assets and financial structures to protect. In some cases, businesses may even have to resort to measures such as asset seizure or filing for bankruptcy if the debtor is unable to repay the debt. The size of the debt often necessitates a more aggressive approach, and businesses are usually well-equipped to navigate these complex financial and legal situations.

Ultimately, the key takeaway is that personal and commercial debt recovery are distinct processes, each with its own set of rules, tools, and challenges. For individuals, personal debt recovery may involve informal steps like communication and negotiation, while commercial debt recovery is more likely to involve formal legal action, arbitration, or bankruptcy.

Understanding these differences is crucial for both creditors and debtors, as it helps ensure that they are approaching the recovery process in the most effective and appropriate way. Whether recovering a personal debt or pursuing a commercial claim, knowing the best legal strategies and when to seek professional assistance is essential to achieving a successful outcome.

· Personal Debt Recovery

· Commercial Debt Recovery

· Debt Collection Strategies

· Consumer Protection Laws

· Business Debt Recovery

· Financial Negotiation

· Legal Enforcement in Debt Recovery

· Ethical Debt Collection

· Alternative Dispute Resolution

· Debt Recovery Legal Framework

· Cross-Border Debt Recovery

· Debt Recovery Challenges and Opportunities

Contact Us

Chaman Law Firm today. Our offices are conveniently located in Lagos, FCT Abuja, Ogun State, and the UK. We are readily available to assist you with your legal needs. Whether you require consultation, representation, or ongoing legal support, Chaman Law Firm is your trusted partner.

Call us at 08065553671 or email us at info@chamanlawfirm.com to schedule a consultation.