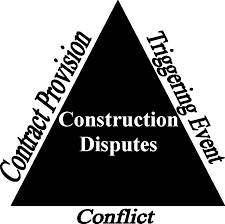

In the realm of construction projects, managing payments is crucial for maintaining cash flow, fostering healthy contractor-client relationships, and ensuring project continuity. However, payment issues and disputes can often arise, leading to delays, disruptions, and strained partnerships. This article explores the complexities of payment issues and disputes in construction contracts, delving into their causes, implications, resolution strategies, and best practices for stakeholders to navigate effectively.

Understanding Payment Issues and Disputes in Construction Contracts

Payment issues and disputes in construction contracts encompass a range of challenges related to the timely and accurate exchange of payments between parties involved in the project. These issues can arise due to various factors, including:

1. Late Payments: Delays in releasing payments from clients to contractors or subcontractors, impacting cash flow and financial stability.

2. Payment Terms: Disputes over payment terms, milestones, invoicing procedures, and compliance with contractual obligations.

3. Progress Payments: Disagreements regarding the calculation, verification, or certification of progress payments based on completed work stages or milestones.

4. Retention: Retention amounts withheld by clients as security against defects or incomplete work, leading to disputes over release conditions and timing.

5. Disputed Work: Disputes arising from disagreements over the quality of workmanship, compliance with specifications, or alleged deficiencies requiring rectification.

Implications of Payment Issues and Disputes

The implications of unresolved payment issues and disputes in construction contracts can be far-reaching:

i. Cash Flow Constraints: Delayed or disputed payments can strain contractor finances, impacting the ability to procure materials, pay subcontractors, and sustain operations.

ii. Project Delays: Disputes over payments can lead to work stoppages, project slowdowns, or disruptions in construction schedules, affecting overall project timelines and completion dates.

iii.Legal and Financial Risks: Non-payment or disputed payments may escalate to legal actions, arbitration, or liens, exposing parties to legal costs, liabilities, and damage to business reputations.

iv. Relationship Strain: Payment disputes can sour relationships between contractors, subcontractors, and clients, eroding trust, communication, and collaborative efforts essential for project success.

Strategies for Resolving Payment Issues and Disputes

Effectively resolving payment issues and disputes requires proactive management, clear communication, and strategic approaches:

1. Contractual Clarity: Ensure payment terms, milestones, invoicing procedures, and dispute resolution mechanisms are clearly defined and documented in the construction contract.

2. Documentation and Records: Maintain accurate records of contract documents, invoices, progress reports, payment receipts, correspondence, and any agreements related to payments.

3. Prompt Invoicing: Submit accurate and timely invoices based on completed work stages or milestones, adhering to contractual requirements and invoicing procedures.

4. Communication Channels: Establish open lines of communication between parties to address payment issues promptly, clarify misunderstandings, and negotiate resolutions.

5. Dispute Resolution Mechanisms: Utilize dispute resolution mechanisms specified in the contract, such as negotiation, mediation, arbitration, or adjudication, to resolve payment disputes efficiently and amicably.

Best Practices for Managing Payment Issues

To mitigate the occurrence of payment issues and disputes in construction contracts, stakeholders can implement best practices:

1. Clear Payment Terms: Include detailed payment terms in contracts, specifying payment milestones, due dates, methods of payment, and consequences for late payments or non-compliance.

2. Progress Monitoring: Monitor project progress closely, track milestones achieved, and verify completed work stages to facilitate accurate and timely progress payments.

3. Payment Security: Implement mechanisms such as performance bonds, advance payments, or milestone-based payments to ensure financial security and mitigate payment risks.

4. Contract Compliance: Adhere to contractual obligations, including payment terms, invoicing procedures, certification requirements, and dispute resolution timelines specified in the contract.

5. Relationship Management: Foster positive relationships through transparent communication, fairness in payment practices, and timely resolution of disputes to build trust and collaboration among project stakeholders.

Steps in Resolving Payment Disputes

Resolving payment disputes in construction contracts involves a structured approach to address issues, negotiate resolutions, and safeguard project interests:

1. Issue Identification: Identify the root cause of the payment dispute, gather relevant documentation, and assess the impact on project timelines, costs, and contractual obligations.

2. Negotiation: Engage in constructive negotiations with all parties involved to explore mutually agreeable solutions, clarify misunderstandings, and reach a settlement regarding disputed payments.

3. Mediation: If negotiations fail to resolve the dispute, consider mediation facilitated by a neutral third party to facilitate communication, explore options, and reach a voluntary agreement.

4. Arbitration or Adjudication: If mediation is unsuccessful, parties may resort to arbitration or adjudication as formal dispute resolution mechanisms specified in the contract to render a binding decision.

5. Legal Recourse: As a last resort, parties may pursue legal action through litigation to resolve payment disputes, enforce contractual rights, and seek remedies or damages for non-payment or breach of contract.

Conclusion

In conclusion, payment issues and disputes in construction contracts pose significant challenges but can be effectively managed through proactive contract management, clear communication, and collaborative dispute resolution strategies. By understanding the causes, implications, resolution strategies, and best practices associated with payment issues and disputes, stakeholders can navigate complexities, protect financial interests, and promote successful project outcomes. Embracing transparency, adherence to contractual obligations, and proactive engagement in dispute resolution are essential for fostering a conducive environment for innovation, growth, and sustainable development in the construction industry. As Nigeria continues its path of infrastructure development and economic growth, a structured approach to managing payment issues and disputes will be instrumental in achieving project success, enhancing stakeholder satisfaction, and fostering long-term relationships built on trust and reliability.

· Payment Disputes

· Construction Contracts

· Cash Flow

· Retention Payments

· Progress Payments

· Invoicing Procedures

· Contractual Clarity

· Payment Terms

· Dispute Resolution

· Arbitration

· Mediation

· Legal Recourse

· Contract Compliance

· Relationship Management

· Project Delays

Contact Us

Chaman Law Firm today. Our offices are conveniently located in Lagos, FCT Abuja, Ogun State, and the UK. We are readily available to assist you with your legal needs. Whether you require consultation, representation, or ongoing legal support, Chaman Law Firm is your trusted partner.

Call us at 08065553671 or email us at info@chamanlawfirm.com to schedule a consultation.