Introduction

Governance practices have a profound effect on business performance, shaping the direction, reputation, and overall success of organizations. Companies with strong governance structures tend to experience higher levels of trust from stakeholders, reduced risk, and enhanced financial performance. In an increasingly complex and regulated business environment, the importance of good governance cannot be overstated. This article delves into how governance practices impact business performance, providing key insights into why effective governance is essential for sustainable growth.

The Role of Governance in Organizational Success

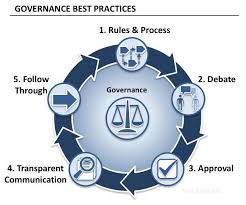

Governance refers to the system of rules, practices, and processes by which a company is directed and controlled. It includes the responsibilities and expectations for board members, executives, and other stakeholders in decision-making, transparency, and accountability. Good governance ensures that companies act in the best interests of their stakeholders, including shareholders, employees, customers, and society at large. It establishes a framework within which businesses operate, fostering a culture of integrity, ethical behavior, and legal compliance.

A well-governed organization can more effectively balance the interests of its stakeholders, which in turn can enhance business performance. Research consistently shows that companies with strong governance frameworks tend to outperform their peers, both financially and operationally. Effective governance not only enhances profitability but also helps in managing risks, avoiding scandals, and protecting the company’s reputation.

Key Governance Practices and Their Impact

Board Effectiveness and Oversight

The board of directors plays a critical role in governance by providing oversight and strategic direction. A well-functioning board ensures that the company’s management acts in the best interest of shareholders and other stakeholders. Boards that include independent directors, have diverse skill sets, and are proactive in reviewing policies and performance can significantly improve business outcomes.

Board effectiveness is linked to a company’s ability to make sound decisions, identify growth opportunities, and manage risks. When boards exercise strong governance, they are better equipped to guide the company through economic challenges, regulatory changes, and competitive pressures. Poor governance, on the other hand, can lead to mismanagement, financial losses, and legal issues, all of which negatively affect business performance.

Transparency and Accountability

Transparency and accountability are cornerstones of good governance. Companies that disclose their financial information accurately and regularly are more likely to build trust with investors, customers, and regulatory bodies. This transparency not only ensures that stakeholders are informed about the company’s financial health but also fosters accountability within the organization.

When business leaders and board members are accountable for their actions, it reduces the risk of unethical behavior and ensures that decisions align with the company’s long-term goals. Accountability also strengthens investor confidence, which can translate into higher stock prices and increased access to capital. In contrast, a lack of transparency can erode stakeholder trust, lead to regulatory penalties, and damage the company’s market position.

Ethical Leadership

Ethical leadership is essential in shaping a company’s governance culture. Leaders who prioritize integrity and ethical behavior set the tone for the entire organization. They ensure that employees at all levels adhere to corporate policies and legal regulations. Ethical leadership also promotes fairness in decision-making, leading to better treatment of stakeholders, including employees, customers, and the community.

Organizations led by ethical leaders are more likely to have a positive reputation and attract talented employees, investors, and customers. Companies with a strong ethical foundation are better positioned to withstand crises and maintain stable performance over time. In contrast, unethical behavior or weak governance can lead to scandals, financial penalties, and long-term damage to the company’s reputation and profitability.

Risk Management One of the most important aspects of governance is the ability to manage risks effectively. Strong governance practices help businesses identify, assess, and mitigate risks before they escalate into major issues. This includes financial, operational, regulatory, and reputational risks. Companies with robust risk management frameworks are better equipped to respond to market volatility, legal challenges, and other unforeseen events.

Effective risk management is a key driver of business performance because it ensures that companies can maintain stability in times of uncertainty. By proactively addressing risks, businesses can avoid costly mistakes and safeguard their assets. Additionally, strong risk management practices can increase investor confidence and improve access to financing, as stakeholders feel more secure in their investments.

Corporate Social Responsibility (CSR)

Corporate Social Responsibility is increasingly becoming a part of governance discussions as businesses are held to higher standards regarding their impact on society and the environment. Companies that prioritize CSR in their governance frameworks demonstrate their commitment to sustainable practices and the well-being of their stakeholders. This can have a direct positive impact on business performance.

CSR initiatives often lead to stronger relationships with customers, employees, and communities. They enhance a company’s reputation, making it more attractive to socially conscious consumers and investors. Moreover, companies that engage in CSR may benefit from tax incentives and improved employee morale, both of which can contribute to better financial performance.

Strategic Decision-Making

Effective governance enables businesses to make informed, strategic decisions that align with their long-term objectives. A strong governance framework ensures that decision-making is based on accurate information, thorough analysis, and consideration of all potential risks and opportunities. When boards and executives collaborate effectively and consider diverse perspectives, they are more likely to implement strategies that drive growth and innovation.

On the contrary, poor governance can lead to impulsive or misinformed decisions that hinder business progress. This can result in lost opportunities, wasted resources, and even financial losses. Companies with strong governance structures can navigate complex business environments more effectively, maintaining agility while pursuing sustainable growth.

The Consequences of Poor Governance

While the benefits of good governance practices are evident, the consequences of poor governance can be disastrous. Companies that fail to establish clear governance policies or enforce accountability often face legal penalties, financial losses, and reputational damage. Poor governance can lead to mismanagement, fraud, and unethical behavior, which in turn erodes trust among investors and other stakeholders.

In extreme cases, poor governance can lead to business failure, as seen in high-profile corporate scandals. Without the proper checks and balances, companies may engage in risky behavior that jeopardizes their long-term viability. Therefore, adopting sound governance practices is not only a matter of compliance but a critical factor in ensuring business success.

Conclusion

The impact of governance practices on business performance is undeniable. Companies with strong governance frameworks are better positioned to achieve long-term success, maintain stakeholder trust, and manage risks effectively. Key governance practices such as board effectiveness, transparency, ethical leadership, and risk management contribute directly to improved business outcomes.

By embracing good governance, organizations can navigate complex challenges, enhance their reputation, and create sustainable value for all stakeholders. In contrast, poor governance can result in financial losses, legal issues, and long-term reputational damage. As businesses continue to evolve in an increasingly competitive and regulated environment, the importance of robust governance practices will only grow in significance.

Contact Us

For premier legal research services in Corporate law cases in Nigeria, contact Chaman Law Firm today. Our offices are conveniently located in Lagos, FCT Abuja, Ogun State, and the UK. We are readily available to assist you with your legal needs. Whether you require consultation, representation, or ongoing legal support, Chaman Law Firm is your trusted partner in navigating Corporate law in Nigeria.

Call us at 08065553671 or email us at info@chamanlawfirm.com to schedule a consultation.

- Mergers and Acquisitions (M&A)

- Corporate Governance

- Securities Law

- Corporate Finance

- Corporate Dispute Resolution

Chaman Law Firm: Your Trusted Legal Partner in Corporate Law

By choosing Chaman Law Firm, you are selecting a team of dedicated professionals committed to providing exceptional legal services tailored to your unique needs. Let us be your advocate and guide in the complex world of Corporate law, ensuring your interests are protected and your goals are achieved.