Powerful Legal Considerations for Corporate Governance and Compliance in Nigeria

Introduction

Corporate governance and compliance are fundamental to the Nigerian business environment, particularly as the country continues to emerge as a hub for investment and commerce. To ensure transparency, accountability, and ethical business practices, companies in Nigeria must navigate a complex regulatory landscape while adhering to local laws and global standards.

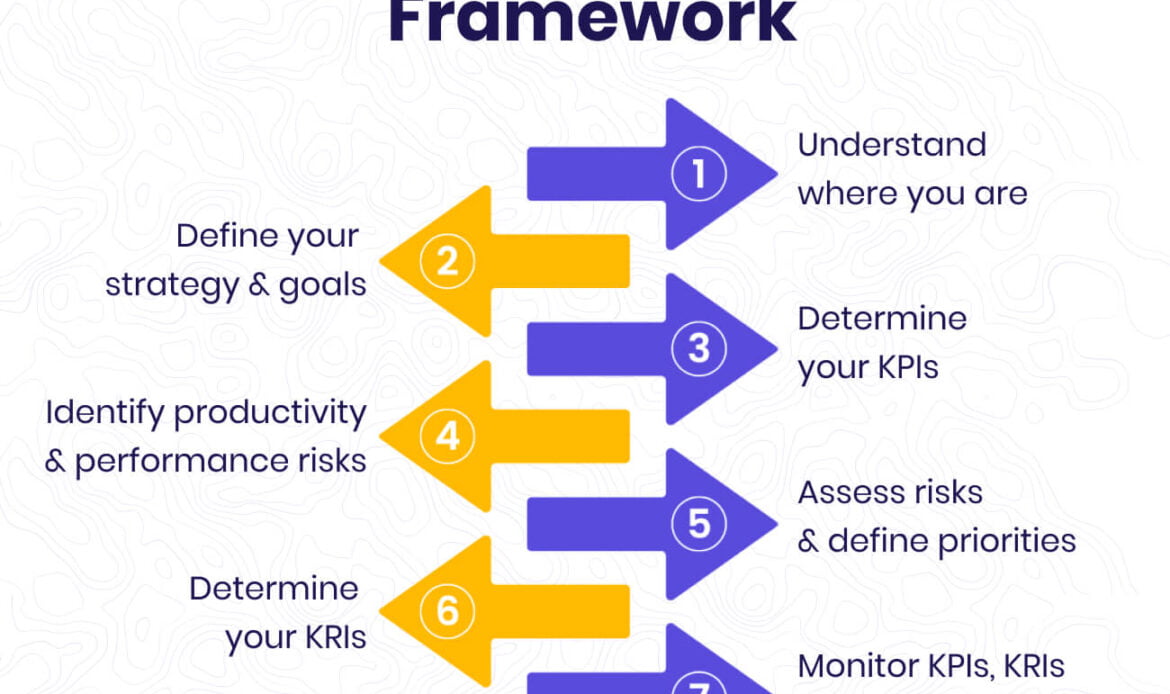

Corporate governance and compliance serve as the twin pillars that uphold the integrity, accountability, and efficiency of modern organizations. In a rapidly evolving business landscape marked by regulatory scrutiny and increasing expectations from stakeholders, companies must adopt a robust governance framework that not only ensures sound decision-making but also guarantees strict adherence to relevant laws, standards, and ethical practices.

At its core, corporate governance is the system of rules, processes, and practices by which a company is directed and controlled. It encompasses the mechanisms through which the board of directors, management, shareholders, and other stakeholders interact to set the company’s strategic objectives, allocate resources, and monitor performance. Effective corporate governance establishes a clear division of responsibilities, ensuring that no single individual or group wields disproportionate power. This balance is critical to mitigate the classic principal–agent problem, where management’s interests may not always align with those of the shareholders. Sound governance practices not only protect investors but also enhance a company’s reputation and long-term sustainability by fostering transparency and promoting ethical conduct .

Compliance, on the other hand, refers to the process by which companies ensure adherence to legal requirements, regulations, and internal policies. It acts as the enforcement arm of corporate governance by establishing guidelines that mandate ethical conduct and the transparent disclosure of financial and non-financial information. In today’s interconnected global economy, adherence to compliance frameworks is essential—not only to avoid legal penalties and reputational damage, but also to build stakeholder confidence. The evolution of compliance has been influenced by landmark regulations such as the Sarbanes–Oxley Act, which heightened the accountability of corporate executives and reinforced the need for accurate financial reporting .

The interplay between corporate governance and compliance is fundamental. A well-structured governance framework relies on strong compliance systems to translate broad ethical and strategic principles into concrete operational practices. For example, while the board may set high-level goals focused on transparency and ethical behavior, an effective compliance program establishes detailed procedures and internal controls to ensure that these objectives are consistently met. This relationship is mutually reinforcing—a robust compliance regime not only enforces governance standards but also provides the board with regular, reliable insights into the organization’s operations, thereby enabling more informed strategic decision-making.

In practice, organizations are increasingly aware that good governance and compliance extend beyond legal obligations. They are integral to risk management, as thorough compliance efforts help identify, assess, and mitigate risks that could derail a company’s strategic objectives. Moreover, proactive compliance with both statutory and voluntary standards—such as environmental, social, and governance (ESG) benchmarks—can enhance a company’s competitiveness by building trust with investors, customers, and the broader community .

Ultimately, corporate governance and compliance work in tandem to build resilient organizations capable of navigating complex regulatory landscapes and evolving market challenges. By investing in comprehensive governance structures and state-of-the-art compliance programs, companies not only secure themselves against legal and financial risks but also lay the foundation for sustainable growth, improved stakeholder relations, and enduring success.

This article outlines key legal considerations for corporate governance and compliance in Nigeria.

1. Regulatory Framework Governing Corporate Governance

Nigeria’s corporate governance framework is defined by several key laws and regulations aimed at promoting responsible business practices and protecting stakeholders’ interests. Among these are:

Companies and Allied Matters Act (CAMA) 2020: CAMA serves as the primary legal framework governing the incorporation, management, and regulation of companies in Nigeria. The 2020 amendment introduced significant changes, such as the requirement for companies to appoint at least one independent director, provisions for single-member companies, and enhanced protections for minority shareholders.

Nigerian Code of Corporate Governance (NCCG) 2018: Issued by the Financial Reporting Council of Nigeria (FRCN), the NCCG provides guidelines on good corporate governance practices. Although largely voluntary, compliance with the NCCG builds trust and credibility, addressing board composition, risk management, audit practices, and stakeholder relations.

Securities and Exchange Commission (SEC) Code of Corporate Governance: Applicable to publicly listed companies, this mandatory code stipulates governance practices such as the separation of the CEO and Chairman roles, the inclusion of independent directors, and the formation of audit, risk, and nomination committees to ensure accountability.

Financial Reporting Council of Nigeria Act (FRCN Act): This Act mandates public companies to prepare financial statements in line with International Financial Reporting Standards (IFRS) and submit them to the FRCN. The Act grants the FRCN authority to enforce corporate governance standards.

2. Fiduciary Duties of the Board of Directors

The board of directors is central to corporate governance in Nigeria. Directors are legally bound to act in the best interests of the company and its shareholders, with fiduciary duties that include:

Duty of Care: Directors must exercise due care, skill, and diligence in decision-making, ensuring they remain informed about the company’s operations and base their decisions on sound judgment.

Duty of Loyalty: Directors are required to prioritize the company’s interests above their own, avoiding conflicts of interest.

Duty of Good Faith: Directors must act honestly and in good faith to promote the success of the company, including disclosing any personal interest in transactions involving the company.

Board composition is also crucial, with the NCCG and SEC Code advocating a balanced mix of executive, non-executive, and independent directors to promote objective decision-making and prevent groupthink.

3. Corporate Compliance Programs

Effective compliance programs are vital for ensuring companies meet legal and regulatory obligations. Key components include:

Code of Ethics and Conduct: Organizations should establish a code of ethics that defines acceptable behavior and decision-making standards, fostering a culture of integrity and ethical responsibility.

Anti-Bribery and Corruption (ABC) Policies: With Nigeria’s stringent anti-corruption laws, including the Corrupt Practices Act and the EFCC Act, companies must implement robust anti-bribery measures to mitigate risks associated with corruption.

Whistleblower Protection: Companies must encourage the reporting of unethical or illegal activities through a whistleblower policy that ensures protection against retaliation, aligned with Nigerian law.

4. Risk Management and Internal Controls

Risk management and internal controls are essential to maintaining corporate governance standards. Legal considerations include:

Internal Controls: Companies must implement systems to ensure the accuracy of financial reporting, safeguard assets, and prevent fraud, as mandated by CAMA 2020 and the FRCN Act.

Enterprise Risk Management (ERM): ERM frameworks help companies identify, assess, and mitigate financial, operational, and regulatory risks. The NCCG encourages businesses to adopt ERM frameworks tailored to their specific operational needs.

5. Transparency and Disclosure

Transparency is a cornerstone of corporate governance. Nigerian law requires companies to disclose material information that could influence investment decisions. Disclosure obligations include:

Financial Reporting: Public companies must prepare and disclose financial statements in accordance with IFRS, overseen by the FRCN to ensure accuracy and compliance.

Material Information Disclosure: Companies must report any material changes affecting their financial condition, operations, or governance, ensuring that stakeholders are adequately informed.

6. Corporate Social Responsibility (CSR) and Ethical Leadership

While Corporate Social Responsibility (CSR) is not yet a legal requirement in Nigeria, it is increasingly recognized as a component of good corporate governance. Companies are encouraged to engage in CSR activities that promote social welfare, sustainability, and ethical labor practices.

Ethical leadership is critical in setting the right tone within an organization. Directors and senior management must lead by example, demonstrating a commitment to ethical behavior, transparency, and compliance with legal standards.

Conclusion

Corporate governance and compliance in Nigeria are governed by a comprehensive legal framework designed to promote transparency, accountability, and ethical practices. By adhering to fiduciary duties, implementing strong compliance programs, fostering ethical leadership, and promoting CSR, companies can build trust with stakeholders, enhance their reputation, and contribute to Nigeria’s sustainable economic development.

Corporate governance and compliance represent the cornerstone of sustainable business practices, providing organizations with a robust framework to navigate today’s complex regulatory landscape. At their essence, these elements ensure transparency, accountability, and ethical behavior—qualities that are indispensable for building trust among stakeholders, investors, and customers. In an environment where corporate missteps can quickly escalate into major public scandals, adopting strong governance principles and stringent compliance measures is not just a regulatory necessity; it is a strategic imperative that drives long‐term success.

A sound corporate governance framework clearly delineates roles and responsibilities, creating a system of checks and balances that align the interests of management, the board, and all stakeholders. This alignment minimizes the risk of unethical practices by ensuring that decision-making processes are transparent and that control mechanisms, such as independent audits and internal reviews, are in place. Such structures not only reinforce accountability but also foster a culture where ethical conduct is valued and rewarded. When employees at all levels observe leadership committed to these principles, a trickle‐down effect is created that embeds integrity into the organization’s very fabric.

Complementing governance efforts, an effective compliance program is crucial in ensuring that an organization adheres to legal requirements and industry standards. Compliance is more than a box‐ticking exercise; it is an ongoing commitment to upholding best practices and mitigating risk. By continuously monitoring regulatory changes and adopting proactive measures, companies can prevent violations before they occur, thus avoiding costly penalties and reputational damage. The integration of technology in compliance processes—such as automated monitoring systems and real‐time risk assessments—further strengthens an organization’s ability to enforce policies consistently and efficiently.

Moreover, robust corporate governance and compliance policies act as catalysts for innovation and growth. They enable companies to identify potential risks early, allocate resources more effectively, and respond nimbly to market shifts. When an organization operates under clearly defined rules and ethics, it establishes a stable foundation for strategic decision-making, which is essential for capitalizing on new opportunities and achieving sustainable competitive advantage. A well-governed and compliant company is also better positioned to attract investment, secure strategic partnerships, and maintain a competitive edge in a rapidly evolving global market.

Additionally, the benefits of strong corporate governance and compliance extend far beyond the confines of the individual organization. They contribute significantly to the overall integrity and stability of financial markets and the economy at large. Transparent governance practices encourage fair competition and create an environment where trust in the business ecosystem is restored and maintained. This, in turn, helps foster economic growth and increases market confidence, which is vital for long-term prosperity.

In conclusion, embracing comprehensive corporate governance and compliance measures is essential for companies striving to achieve ethical integrity, operational resilience, and sustainable success. By embedding these principles within their corporate DNA, organizations not only safeguard themselves against risks and regulatory pitfalls but also set the stage for enduring growth and value creation in an increasingly scrutinized global marketplace. This unwavering commitment to ethical leadership ultimately builds a legacy of trust and excellence, which is the true hallmark of a forward-thinking and responsible enterprise.

. Corporate governance

. Regulatory compliance

. Fiduciary duties

. Nigerian Code of Corporate Governance

. Companies and Allied Matters Act (CAMA)

. Anti-bribery policies

. Internal controls

. Enterprise Risk Management (ERM)

. Financial disclosure

. Corporate Social Responsibility (CSR)

Contact Us

Chaman Law Firm today. Our offices are conveniently located in Lagos, FCT Abuja, Ogun State, and the UK. We are readily available to assist you with your legal needs. Whether you require consultation, representation, or ongoing legal support, Chaman Law Firm is your trusted partner.

Call us at 08065553671 or email us at info@chamanlawfirm.com to schedule a consultation.