Essential Understanding of the Rights of Stakeholders in Insolvency: Navigating Critical Challenges

Introduction

Insolvency is a complex and often daunting process, one that impacts multiple parties connected to the financial health of an organization. From creditors to employees and shareholders, all stakeholders in insolvency have legal rights that are essential to the resolution of the financial distress. Understanding these rights not only helps in ensuring that stakeholders can protect their interests but also helps them to engage constructively with the insolvency process. This article explores the various rights stakeholders hold during insolvency proceedings, outlining the responsibilities of insolvency practitioners and the legal protections in place to balance competing interests.

Insolvency, a term often met with dread, represents a pivotal point in any business lifecycle—a legal state where a debtor is unable to meet its financial obligations. For stakeholders—ranging from creditors, investors, employees, to suppliers and even government agencies—the implications of insolvency can be devastating. Yet, amidst the uncertainty and financial turbulence, stakeholders possess rights, legal protections, and recourses that must not only be understood but actively enforced.

Understanding these rights is not just a matter of legal necessity; it is a survival strategy, a shield against financial ruin, and a guide through the labyrinth of legal and procedural hurdles in insolvency. Stakeholders who remain unaware of their standing risk marginalization, loss of assets, or worse, complete exclusion from the decision-making processes that follow insolvency declarations. In contrast, those who are informed can assert their rights, influence restructuring processes, and, in some cases, recover their interests or even become vital contributors to the revival of the insolvent entity.

The issue becomes even more critical in jurisdictions where insolvency frameworks are undergoing reform or where enforcement mechanisms are inconsistent or fraught with delays. Nigeria, for instance, introduced the Companies and Allied Matters Act (CAMA) 2020, which brought significant changes to the insolvency regime. These reforms, while promising, also introduced new complexities—making it essential for stakeholders to stay informed, proactive, and well-advised.

This article explores the essential rights of stakeholders in insolvency, drawing attention to the mechanisms available for protection, redress, and participation. We will navigate the legal definitions, statutory safeguards, judicial precedents, and practical realities faced by stakeholders. Our aim is not only to clarify the “what” of stakeholder rights but also the “how”—how to enforce them, how to anticipate challenges, and how to adapt to evolving insolvency landscapes.

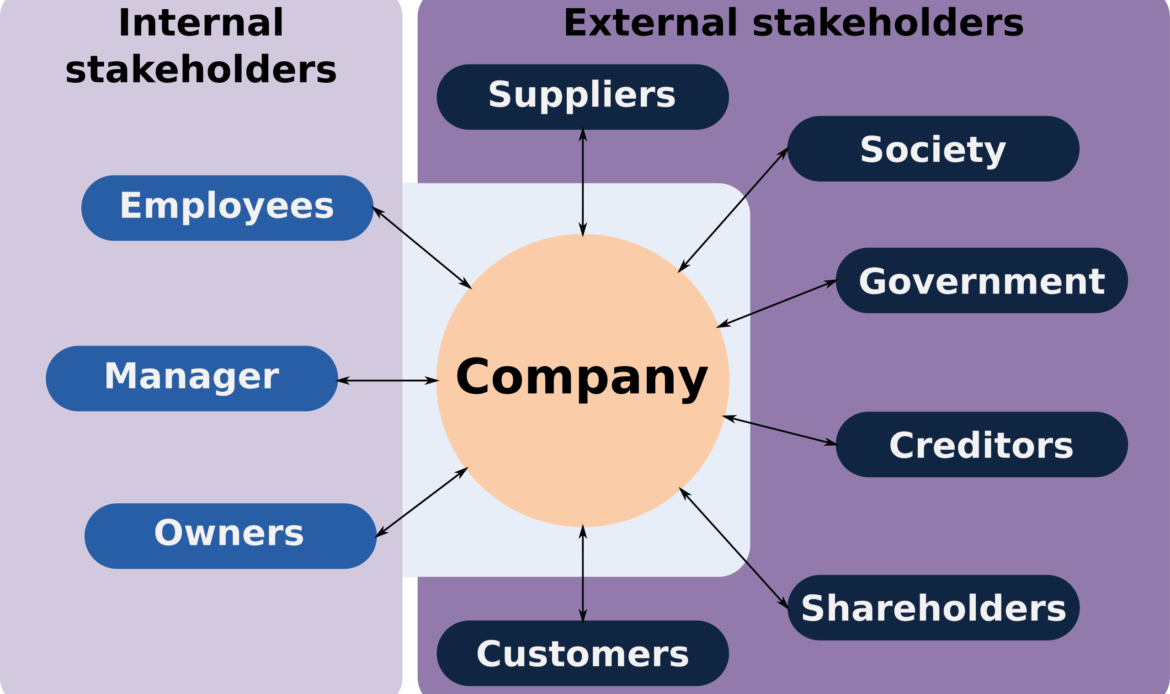

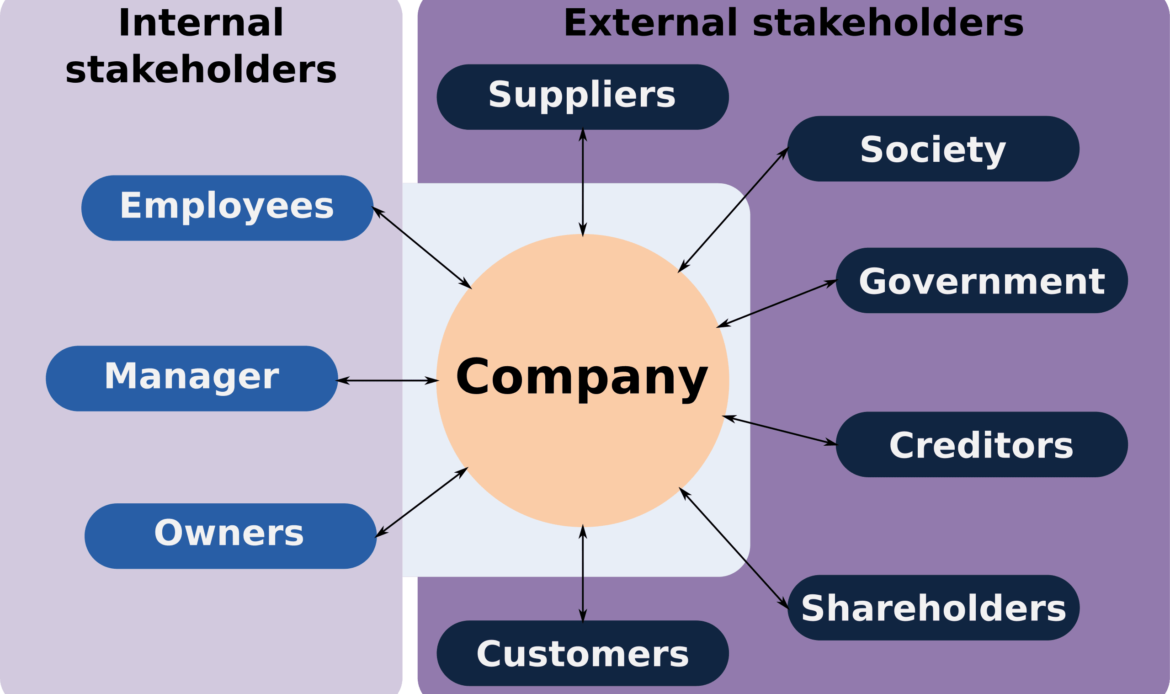

First, it’s important to define who stakeholders are in the context of insolvency. While creditors (secured and unsecured) often take the spotlight, the stakeholder umbrella extends wider. Shareholders, employees, trade unions, pensioners, suppliers, tax authorities, and regulatory agencies all possess a vested interest in the outcome of insolvency proceedings. Each group holds unique legal rights and liabilities, and their ability to assert these rights depends on their classification under the insolvency framework.

Secured creditors, for example, enjoy preferential rights to enforce their security, often placing them in a better position to recover debts than unsecured creditors. However, their rights are not absolute and can be curtailed in certain circumstances—such as in the event of a moratorium or court-imposed restructuring. Unsecured creditors, while more vulnerable, may form committees to influence the distribution plan and restructuring proposals.

Employees, on the other hand, may benefit from protections regarding unpaid wages and compensation, often ranking higher than unsecured creditors in the payment waterfall. Shareholders, being residual claimants, face the highest risk—but also possess voting rights in major decisions like company liquidation or restructuring schemes.

Despite these outlined rights, stakeholders frequently encounter challenges such as lack of transparency, prolonged court proceedings, insider favoritism, and conflicting interests among different groups. The lack of financial and legal literacy among small and medium stakeholders compounds the problem, leaving many without proper representation or voice during crucial insolvency deliberations.

Legal reform alone is not enough. There is a pressing need for increased stakeholder awareness, legal advocacy, and institutional support. Stakeholders must understand not only their entitlements but also the strategic tools at their disposal: filing claims promptly, objecting to unfair arrangements, initiating legal action where necessary, and participating actively in creditors’ meetings and committees.

The judiciary also plays a critical role. Through case law, courts shape the interpretation and application of insolvency statutes, sometimes providing relief where statutory protections fall short. For instance, Nigerian courts have shown increasing willingness to prioritize stakeholder engagement and equitable treatment, particularly in high-profile insolvency cases.

Furthermore, international best practices such as the UNCITRAL Model Law on Cross-Border Insolvency and the World Bank’s principles for effective insolvency systems offer guidance that can help stakeholders benchmark their local rights and expectations.

As businesses navigate increasingly uncertain economic climates—driven by inflation, regulatory tightening, and global trade shocks—the likelihood of insolvency events is bound to rise. For stakeholders, the question is no longer whether insolvency will happen, but when—and whether they will be prepared to respond.

In this guide, we arm you with the knowledge and practical insights necessary to protect your interests. Whether you are a creditor seeking to recover funds, an employee concerned about your benefits, or a shareholder evaluating your options, understanding your legal standing is the first step toward empowerment.

What is Insolvency?

Insolvency refers to the situation where an individual or a company is unable to pay off their debts when they fall due. Insolvency can take various forms, ranging from complete liquidation to corporate restructuring aimed at rescuing the company. Understanding the rights of stakeholders in insolvency begins with distinguishing between two major forms of insolvency:

-

-

Cash-flow insolvency

: This occurs when a business is unable to pay its debts as they become due, despite having sufficient assets.

-

-

-

Balance-sheet insolvency: In this scenario, the company’s liabilities exceed its assets, meaning it owes more than it owns.

-

For both types of insolvency, legal frameworks exist to determine how assets should be managed, creditors should be paid, and employees should be treated. This legal framework, which governs the rights of all involved stakeholders, varies from country to country but typically revolves around common principles of fairness, transparency, and accountability.

Key Stakeholders in Insolvency

In any insolvency process, the following stakeholders are critical:

-

-

Creditors

: These include secured creditors, unsecured creditors, and preferential creditors, all of whom have rights related to repayment of the debt owed to them.

-

-

-

Employees

: As individuals whose livelihoods are impacted by the insolvency process, employees have rights to wages, benefits, and severance pay.

-

-

- Shareholders: Shareholders hold ownership in the company and have certain residual rights after all creditors are paid.Directors and Officers

: The company’s management team must navigate their fiduciary duties while ensuring compliance with the legal obligations that arise during insolvency.

Insolvency Practitioners:

These professionals, often appointed by courts or creditors, manage the insolvency process and ensure that all stakeholders’ rights are respected.

- Shareholders: Shareholders hold ownership in the company and have certain residual rights after all creditors are paid.Directors and Officers

Understanding the Rights of Creditors in Insolvency

Creditors are among the most crucial stakeholders in any insolvency process, as they are owed money by the insolvent company. Their rights vary depending on whether they are secured, unsecured, or preferential creditors.

-

-

Secured Creditors: These creditors have lent money against a specific asset or collateral, such as property or equipment. In the event of insolvency, secured creditors have the right to seize and sell the secured assets to recover their money. They are given priority in receiving payment over other creditors because their loans are backed by valuable assets.

-

-

-

Unsecured Creditors

: These creditors do not have a claim to any specific assets and are considered to be at higher risk during insolvency. Their rights include the ability to file claims for unpaid debts and vote on any restructuring or liquidation plans. However, they are paid only after secured and preferential creditors are satisfied, often receiving reduced or no repayment.

-

-

-

Preferential Creditors

: Preferential creditors hold special status due to the nature of their claims, such as unpaid wages or certain taxes owed to the government. Their claims are paid before unsecured creditors but after secured creditors. For example, in many jurisdictions, employees owed wages or pension contributions are classified as preferential creditors.

-

Rights of Employees in Insolvency

Employees are another critical group whose rights must be protected during insolvency. Insolvency law often includes provisions that ensure employees are treated fairly, even when their employer is unable to continue operating. Key employee rights during insolvency include:

-

-

Wage Claims

: Employees are entitled to unpaid wages up to a certain amount, and in many jurisdictions, these claims are given preferential status, ensuring they are paid ahead of other unsecured creditors.

-

-

-

Severance Pay

: If the company is liquidated, employees have the right to severance pay, depending on the length of their employment and applicable labor laws. In some countries, government schemes may cover these payments if the company cannot meet its obligations.

-

-

-

Redundancy Compensation

: In cases where the company is restructured, resulting in layoffs, employees have the right to redundancy compensation. Employers are typically required to provide notice of impending layoffs and consult with employees before dismissing them.

-

-

-

Transfer of Employment Rights

: When a business is sold during insolvency proceedings, employees may have the right to transfer their employment contracts to the new owner. This process ensures continuity of employment and preserves employee rights.

-

Shareholders’ Rights in Insolvency

While shareholders hold ownership rights in a company, their rights in insolvency are generally subordinate to those of creditors. Shareholders’ main rights during insolvency include:

-

-

Residual Claims

: Once all creditors have been paid, shareholders may have the right to any remaining assets. However, in most cases of insolvency, especially liquidation, there are no surplus assets left after the creditors have been paid.

-

-

-

Voting on Restructuring Proposals

: In some insolvency processes, particularly company voluntary arrangements (CVA) or restructuring, shareholders may be given the opportunity to vote on the proposed plans. This allows them to have a say in the company’s future direction, though their influence is usually limited compared to that of creditors.

-

-

-

Information Rights

: Shareholders have the right to be kept informed about the insolvency proceedings. This includes receiving periodic reports from insolvency practitioners on the progress of the liquidation or restructuring.

-

Rights of Insolvency Practitioners

Insolvency practitioners are appointed to oversee and manage the insolvency process, ensuring that all stakeholders are treated fairly and in accordance with the law. Their primary responsibilities include:

-

-

Managing the Company’s Assets

: Insolvency practitioners take control of the company’s assets and are responsible for selling them off or reorganizing the company to repay creditors.

-

-

-

Paying Creditors

: Insolvency practitioners distribute the proceeds from asset sales or restructuring to creditors in accordance with the legal hierarchy of claims. They must ensure that secured, unsecured, and preferential creditors are paid in the correct order.

-

-

-

Providing Information

: Insolvency practitioners are required to provide regular updates to stakeholders about the status of the insolvency process, including financial reports and details about how the company’s assets are being handled.

-

Conclusion

Understanding the rights of stakeholders in insolvency is essential for navigating the often complex and sensitive insolvency process. Creditors, employees, shareholders, and insolvency practitioners all have specific roles and responsibilities that are critical to resolving financial distress in a fair and transparent manner. By recognizing these rights, stakeholders can protect their interests and engage effectively in the insolvency process, ensuring that they receive the treatment and compensation they are entitled to under the law.

The complexity of insolvency proceedings often masks a harsh truth: not all stakeholders emerge unscathed. For many, the process marks a painful period of financial loss, operational disruption, and emotional toll. However, the presence of legal rights and institutional remedies offers a path—not always easy, but undeniably vital—toward protection and, in some cases, recovery.

As we have explored, the rights of stakeholders in insolvency are neither monolithic nor static. They are shaped by statutes, modified by judicial interpretations, and influenced by market realities and policy reforms. For every stakeholder group—be it secured creditor, trade supplier, employee, or investor—there exists a unique position within the legal architecture of insolvency, with corresponding rights and responsibilities.

What distinguishes successful stakeholders from the rest is not just legal representation or financial leverage, but the clarity of understanding and timely engagement. Insolvency processes are governed by tight deadlines, procedural formalities, and strict disclosure requirements. Missing a single window—like failing to file a proof of claim—can mean exclusion from the entire process.

Beyond procedural participation, stakeholders must embrace a proactive approach. That means forming alliances, especially for smaller or unsecured creditors, to enhance bargaining power. It also means challenging unjust distributions, advocating for equitable treatment, and leveraging judicial remedies when necessary.

In systems like Nigeria’s, where recent reforms aim to align insolvency practice with global standards, there is room for cautious optimism. The inclusion of business rescue mechanisms such as company voluntary arrangements (CVAs) and administration provides viable alternatives to liquidation, preserving value for stakeholders and saving viable businesses from total collapse.

Yet challenges persist. Institutional inefficiency, legal delays, and administrative bottlenecks continue to frustrate stakeholders. The lack of centralized insolvency registers, limited expertise among court-appointed administrators, and poor communication from insolvent entities are recurring problems that stakeholders must actively work around or challenge through legal channels.

One of the most urgent needs is education. Many stakeholders, particularly in developing economies, remain unaware of their rights until it’s too late. Empowerment begins with access—to legal information, qualified representation, and open channels of participation. Government bodies, trade associations, and civil society organizations must step up to close this gap, offering training, support, and advocacy for affected parties.

Moreover, the global nature of commerce has introduced cross-border insolvency issues, where stakeholders may need to assert their rights across multiple jurisdictions. In such cases, familiarity with treaties, mutual recognition agreements, and international insolvency cooperation frameworks becomes essential. This is particularly relevant in investment-heavy sectors like oil & gas, fintech, and telecommunications, where corporate insolvency has cross-border implications.

Ultimately, stakeholder rights in insolvency are not just legal provisions—they are tools of justice, equity, and resilience. Businesses may rise and fall, but the rule of law and the protection it affords must remain firm. By understanding their roles, asserting their rights, and demanding accountability, stakeholders can transform insolvency from a crisis into a turning point—both for themselves and for the broader economy.

Whether you are reading this as a lawyer advising clients, a business owner bracing for financial restructuring, or an individual trying to safeguard your claim, remember this: in the face of insolvency, knowledge is your strongest asset, and engagement is your best strategy.

The road through insolvency may be rough, but armed with insight, determination, and the right legal approach, stakeholders can emerge not as victims—but as empowered participants in shaping the future of troubled enterprises.

Contact Us

For premier legal research services in Insolvency law cases in Nigeria, contact Chaman Law Firm today. Our offices are conveniently located in Lagos, FCT Abuja, Ogun State, and the UK. We are readily available to assist you with your legal needs. Whether you require consultation, representation, or ongoing legal support, Chaman Law Firm is your trusted partner in navigating Insolvency law in Nigeria.

Call us at 08065553671 or email us at info@chamanlawfirm.com to schedule a consultation.

- Bankruptcy Law

- Liquidation Procedures

- Corporate Restructuring

- Creditor Rights

- Personal Insolvency

Chaman Law Firm: Your Trusted Legal Partner in Insolvency Law

By choosing Chaman Law Firm, you are selecting a team of dedicated professionals committed to providing exceptional legal services tailored to your unique needs. Let us be your advocate and guide in the complex world of Insolvency law, ensuring your interests are protected and your goals are achieved.