Powerful Strategies For Staying Ahead In Regulatory Compliance And Avoiding Costly Pitfalls

Introduction

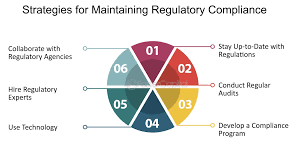

Regulatory Compliance Strategies;

In the ever-evolving landscape of modern business, regulatory compliance has become more than just a box to check — it’s a fundamental pillar of responsible and sustainable corporate governance. Whether you’re running a multinational corporation or a small enterprise, compliance with industry-specific laws, government regulations, and internal policies is essential to ensure the smooth operation and legal integrity of your organization. The failure to meet these obligations doesn’t only result in legal sanctions or financial penalties — it also threatens reputational damage, investor distrust, and operational setbacks that can stall long-term growth.

At its core, regulatory compliance refers to a company’s adherence to laws, guidelines, and specifications relevant to its business processes. These regulations can be local, national, or international depending on the scope of the business and the industry in which it operates. In Nigeria, for example, companies must comply with laws such as the Companies and Allied Matters Act (CAMA), regulations by the Corporate Affairs Commission (CAC), the Financial Reporting Council of Nigeria (FRCN), the Securities and Exchange Commission (SEC), and other industry-specific bodies like the Nigerian Communications Commission (NCC) or the Central Bank of Nigeria (CBN). Globally, there are compliance frameworks such as the Sarbanes-Oxley Act, GDPR (General Data Protection Regulation), HIPAA (for healthcare), and ISO standards that govern corporate accountability.

With increasing regulatory scrutiny and a rapidly changing legal landscape, many organizations are finding it difficult to keep pace. Regulations are frequently updated to reflect shifts in policy, technological innovation, environmental concerns, data privacy demands, and evolving financial reporting standards. What may have been compliant a year ago may now pose legal risks. Moreover, the growing interconnectedness of the global economy means that businesses can no longer isolate themselves from international compliance obligations. Cross-border transactions, remote operations, and digital services make it imperative to comply not just with local, but also international standards.

In this context, the phrase “ignorance of the law is no excuse” takes on a much deeper meaning. Corporate leaders, compliance officers, legal advisors, and even frontline employees have a role to play in ensuring that compliance is woven into the very fabric of the organizational culture. While it may sound overwhelming, the solution lies in developing and executing effective strategies that not only ensure compliance but also improve operational efficiency, minimize risk, and foster a culture of ethical conduct.

Let’s also recognize that regulatory compliance is not solely a legal function. It spans various dimensions of an organization — from HR and procurement to finance, marketing, and IT. Consider how compliance with anti-money laundering (AML) regulations affects finance departments, or how data protection regulations like GDPR or NDPR affect how marketing teams collect and store consumer data. Therefore, compliance must be seen as a cross-functional effort, requiring alignment, coordination, and communication across departments.

A strong compliance program helps businesses achieve several goals:

•Risk mitigation: By staying compliant, organizations minimize the risk of fines, lawsuits, or business shutdowns.

•Investor and stakeholder confidence: Compliance demonstrates a commitment to governance, accountability, and ethical behavior, increasing investor trust.

•Operational efficiency: Well-designed compliance frameworks streamline operations and reduce the chances of errors or breaches.

•Market reputation: Companies known for strong compliance are more attractive to clients, partners, and regulatory bodies.

•Competitive advantage: In some industries, compliance can be a strategic asset. For example, in fintech, being fully compliant with CBN guidelines can earn a startup more trust and funding than non-compliant competitors.

However, the journey toward compliance is not without its challenges. Organizations often struggle with vague regulatory interpretations, inconsistent enforcement, lack of internal expertise, high implementation costs, and resistance to change from staff. Moreover, small and medium-sized enterprises (SMEs) often lack the resources to maintain full-time compliance teams or invest in expensive compliance management tools. Multinational corporations, on the other hand, must grapple with the complexity of operating under different regulatory regimes across various jurisdictions.

This is where strategies come in. Strategies for maintaining regulatory compliance are structured approaches that organizations can adopt to meet their regulatory obligations consistently and efficiently. These strategies vary based on industry, company size, geographical location, and legal exposure, but they typically revolve around key pillars such as risk assessment, internal audits, staff training, compliance software, legal advisory support, and continuous monitoring.

One of the most important strategic steps is to foster a compliance culture. This means ensuring that compliance is not just a one-time project or an annual audit checkbox, but an integral part of daily decision-making. A compliance culture starts from the top, with executives and board members setting the tone and leading by example. When leadership shows a strong commitment to ethical business conduct, it trickles down to every employee.

Another critical strategy is to establish clear policies and procedures. These documents should outline acceptable business practices, define roles and responsibilities, and include steps for reporting, investigating, and resolving compliance issues. It’s not enough to have these policies in place — they must be accessible, up to date, and regularly reviewed to reflect regulatory changes.

Technology also plays a vital role in modern compliance strategies. Compliance management systems and regulatory technology (RegTech) tools help automate risk assessments, monitor transactions, store policy documents, and alert organizations to new regulatory developments. For example, Nigerian fintech firms may use RegTech to track changes in CBN guidelines and adjust their internal operations in real-time.

Similarly, staff training and awareness programs ensure that employees understand the regulations relevant to their roles. Regular training sessions, workshops, and digital learning platforms can instill a strong understanding of compliance responsibilities and encourage employees to act as the first line of defense against violations.

Finally, a proactive strategy involves periodic audits and internal reviews. These processes help identify gaps before regulators do and allow companies to take corrective action early. Engaging external auditors or legal experts can bring objectivity and specialized insights, especially in industries where compliance requirements are highly technical or niche.

In conclusion, regulatory compliance is not just a legal obligation — it’s a strategic necessity. Organizations that invest in robust compliance strategies position themselves for long-term success in a complex and fast-paced global economy. As we delve into this topic further, we’ll explore specific and actionable strategies that businesses can implement to ensure they stay compliant while driving innovation, growth, and stakeholder value.

In today’s dynamic business and legal landscape, regulatory compliance is crucial for organizations of all sizes. Compliance refers to adhering to laws, regulations, standards, and internal policies that govern business operations. The primary goal is to ensure that organizations and individuals operate within the legal framework, avoiding actions that may result in penalties, fines, or reputational damage.

Effective Strategies for Regulatory Compliance

To ensure ongoing regulatory compliance, businesses must implement the following strategic approaches:

1. Understand Relevant Laws and Regulations

The foundational step in maintaining compliance is identifying and understanding the laws and regulations applicable to your business. As the legal principle “Ignorantia legis neminem excusat” states, ignorance of the law is no excuse. Therefore, it’s essential for organizations to stay informed of all relevant legal obligations.

2. Develop Comprehensive Policies and Procedures

Create detailed policies and procedures that outline the steps your organization must take to comply with regulations. Regularly update these policies to reflect changes in the regulatory environment.

3. Establish a Compliance Team

Assign a dedicated compliance officer or team responsible for overseeing compliance initiatives. This team should be knowledgeable about the relevant laws and empowered to enforce compliance across the organization.

4. Provide Ongoing Training

Regular training is essential to ensure that employees understand their compliance responsibilities. Educating staff on the importance of regulatory adherence helps reduce the risk of non-compliance.

5. Conduct Regular Risk Assessments

Identify areas of potential non-compliance through regular risk assessments. Proactively addressing these risks prevents them from escalating into larger issues. Risk management strategies, such as improved processes or increased oversight, should be implemented to mitigate identified risks.

6. Monitor and Audit Compliance Practices

Continuously monitor compliance efforts and conduct regular audits. Use audit findings to refine and strengthen compliance strategies, ensuring ongoing adherence to regulations.

7. Leverage Technology

Compliance management software can streamline record-keeping, track regulatory changes, and alert you to potential issues. Integrating technology with your compliance system ensures you stay updated on evolving regulations.

8. Foster a Culture of Compliance

Cultivating an organizational culture that prioritizes ethical behavior and regulatory compliance is key. Leadership must model compliance-focused behavior, and employees should feel encouraged to report potential issues without fear of retaliation.

9. Maintain Communication with Regulators

Keep open lines of communication with regulatory bodies. Transparency in compliance efforts and seeking guidance when necessary fosters a positive relationship with regulators, enhancing overall compliance.

10. Engage in Industry Groups and Associations

Participating in industry groups that provide regulatory guidance can help organizations stay informed about industry-specific compliance requirements. These groups also serve as valuable resources for benchmarking and improving compliance practices.

11. Prepare for Regulatory Inspections

Conduct mock inspections to ensure readiness for regulatory audits. This proactive approach allows you to address any gaps in compliance before facing real inspections.

12. Review and Improve Compliance Practices

Regulatory compliance is not a one-time task but an ongoing process. Regularly reviewing and refining compliance strategies ensures that organizations can adapt to regulatory changes. Benchmarking against industry standards can reveal areas for improvement and help maintain or exceed compliance expectations.

Maintaining regulatory compliance requires consistent effort and dedication. By implementing a well-rounded compliance program, conducting regular risk assessments, utilizing technology, fostering a compliance culture, engaging with regulators, and continuously reviewing practices, organizations can successfully navigate the complexities of the regulatory environment and minimize the risks of non-compliance.

. Regulatory compliance

. Risk assessments

. Compliance officer

. Compliance management software

. Ethical behavior

. Regulatory updates

. Industry standards

. Compliance audits

. Legal framework

. Compliance culture

Contact Us

Chaman Law Firm today. Our offices are conveniently located in Lagos, FCT Abuja, Ogun State, and the UK. We are readily available to assist you with your legal needs. Whether you require consultation, representation, or ongoing legal support, Chaman Law Firm is your trusted partner.

Call us at 08065553671 or email us at info@chamanlawfirm.com to schedule a consultation.